Logic Locking: Does it have unacknowledged role in chip shortages?

The 20’s Roaring Chip Shortage: Takeaways from the close of 2022

Note to the reader: For this post the term Integrated Circuit is abbreviated to IC and can just be thought of as a fancy term for microchip logic.

Proclamations of a chip glut are everywhere. Intel, after establishing a $50B subsidy from congress, has just announced one of its worst quarters ever due to this tremendous chip glut that has happened all of the sudden. Yet automakers are still paying “eye-watering prices” for auto-chips that Bloomberg is calling gray market.

It is far from 2022’s greatest paradox but it still begs for an explanation. Everyone either has not enough or too many microchips.

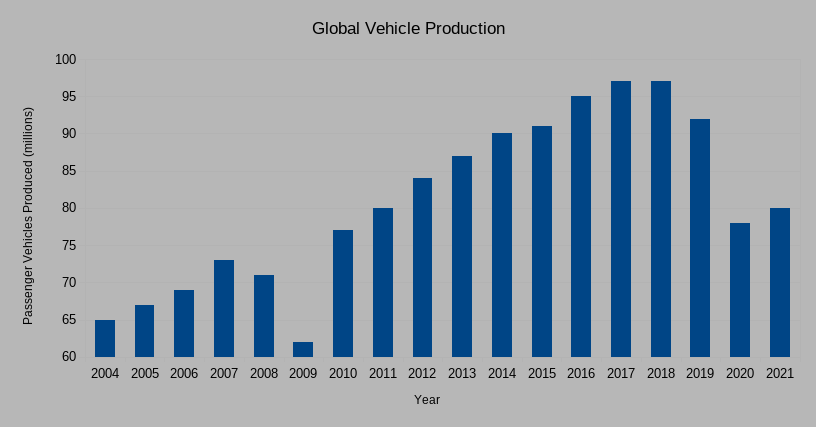

Almost every person on earth has felt the impact of the chip shortage. Even now it remains fresh in consumers’ minds that used car prices had inflated at least 41% this past March according to the Senate Commerce Committee[0] and shortages will keep car prices high well into 2023, possibly beyond[1]. We should be asking the question, what role might logic locking have had in the chip shortage?

Partial blame has been placed everywhere except on logic locking, it seems. Senators blame too many of the cutting edge foundries being in Taiwan. Higher demand for consumer electronics in the wake of the work-from-home and school-from-home shift seems to have had some role. And even fears of trade-war escalation with China seems to have had a partial impact with Chinese firms willing to pay a premium to import the state-of-the-art 7nm and 4nm chips that they have been embargoed from being allowed to produce themselves. And good god, we even have the contradictory claims from Bloomberg and WSJ that auto-chips are too “legacy” and cheap to entice chipmakers into production, while the Financial Times just claimed the exact opposite 5 days before Christmas, stating some “advanced power semiconductors” for automobiles are already sold-out through 2023 due to the race to switch to electric cars[2].

When narratives are this varied, the truth often lies unacknowledged somewhere in the middle of these contrasting claims. Most stated things don’t seem to explain the prolonged chip shortage we have today. Rather, they just largely seem part of a campaign to get the $75B corporate hand out, The Chips Act, passed. The same also goes for its multibillion euro corollary bill that the EU did, not to mention other earmarks. And without a principled understanding of what happened and why, we can’t be sure the corrections that are falling into place will prevent a repeat of the same mistakes.

After all, the existence of cars predated the existence of computer chips; and the 1994 Isuzu pickup-truck was the last model car to be carburated, meaning it was the last personal vehicle that did not require a modern semiconductor to be retailed. And by many accounts carburated cars were becoming less reliable as automakers adapted them to meet ever lowing emissions standards. That is the bleak reality of how carbureted vehicles were forced out of the marketplace, artificially inducing automakers first reliance on microchips for their fuel injection systems through government regulation.

But peering through the contemporary journalistic nonsense, there is one thing most seem to be getting right. This bad of a chip shortage could have been caused by producers – like car companies – being unwilling to stockpile computer chips.

Still, even that doesn’t tell the whole story. In truth, it would seem very reasonable that automakers did not stockpile chips. But the narrative being pushed, stated as fact even, is that these companies “are [only] now realizing the importance of semiconductors” as if all of them were too incompetent to understand their own supply-chain vulnerabilities[0,1,2,3]. I tend to think car companies a little more competent than that type of decision would portray them.

A clear-eyed view of how this shortage happened needs to be done as we bear in mind the words of Senate Commerce Committee Chair Cantwell. As she said it, this is about those who are feeling the most inflationary pain: “it’s the person whose radiator blew out last week and just needs anything on four wheels that can get them to their job.” The person whose “next month rent can’t get paid.”

Why weren’t they stockpiling the chips?

Since at least the mid-2000s, computer chips have been an artificially scarce product. Simply put, chipmakers know they need to elude antitrust and anti-competitive litigation. Until now, the claim from academics has been that design theft and supply-chain security are both protected with a technique known as logic locking. This rationale has always been weak at best, which makes it appear that chipmakers have long ago bought and paid for the opinions of infotech academics such that many portend that this artificial chip scarcity induced by logic locking is intrinsically linked with supply-chain security.[4,9,10]

Luckily, this rationale can no longer be pretended to hold as a comprehensive study published just this August concluded “logic locking is an insufficient countermeasure in the presence of invasive attacks.”[5]

So, in reality, today’s semiconductor market operates as one big rent-seeking scheme. To understand the brazen lack of enforcement on this anti-competitive behavior among the so called “fabless”1 semiconductor companies we can also look to the rationale of the sometimes eloquent Alan Greenspan who once famously wrote:

The world of antitrust is reminiscent of Alice’s Wonderland: everything seemingly is, yet apparently isn’t, simultaneously.

To be sure, antitrust would likely not be an effective remedy because chip designs are copyrighted. Copyright legal precedents — as opposed to patents — have largely not had to deal with copyrighted designs being able to grind economies of scale to a halt like the commodity automotive computer chips have done2. One of the assumptions of copyright law is that the owner of the copyright can be trusted with their own goodwill insofar that they have an incentive to see their work proliferate, but chip designs have flipped this assumption about copyright on it’s head. Copyrighted chip designs are so locked down that: not even the alleged deaths they caused to 89 people were able to get the chip designs in question released to NASA for their investigation prior to the 2013 Bookout v. Toyota Motor case that resulted from one of those 89 auto-chip induced deaths[6].

Unpacking this all a bit more, let’s look at how two companies were innovative enough to survive the 2021 shortages relatively unscathed. Tesla rewrote much of its firmware to accommodate the chips it could get its hands on but that was only possible because they are so cash flush from their crazy high P/E. And Toyota bit the bullet on a scheme for stockpiling needed chips. It appears this scheme was implemented shortly after their cars started accelerating uncontrollably because of the flawed microchips that resulted in the deaths of those 89 customers accelerating well beyond 100 Mph in the late 2000s[7].

One of those customers even called 9-1-1 as his Lexus uncontrollably reached top speed. He crashed and died along with his family in the car while on the phone with the dispatcher that was captured in this horrifying audio.

That crash killed all four family members in the car including the 13 year old girl who you can hear scream as that flawed microchip hurled her family’s Lexus toward an intersection.

What is important to draw from this is that Toyota used to have a no-black-boxes policy when it came to the chips it used; in 2002 Toyota was refusing to use chips it could not itself audit and understand. That is to say in computer engineering terms, Toyota at least used to know what logic exists inside the chips it used. They even bragged about this in their book, a management genre bestseller: The Toyota Way. Though interestingly, they only bragged about auditing their chips in the 2002 first edition; not in the 2021 second edition. And in 2013 Toyota quickly settled the rest of its chip related lawsuits around the country when a jury handed down a verdict in the Bookout v. Toyota Motor case against Toyota. The jury agreed that Toyota’s computer systems were responsible in the death of an Oklahoma man in 2005. This was after the NASA study reverse engineered the Toyota throttle system and could not rule out a “malfunction in the main central processing unit (CPU)” presumably because even they weren’t able to get granted access to the CPU’s trade-secret chip designs.

After NASA failed to make a conclusion, a deeper investigation – which included the trade-secret chip design blueprints held under court order – concluded the chips Toyota was using had “no hardware protection available against [memory] bit flips."3 Said another way, independent computer security investigators found the chips Toyota was using didn’t have proper error correcting codes in their on-chip memory! And that was instrumental to what most likely caused the car crashes like the one in the horrific recording from above.4 But they could not determine exactly what caused unintended acceleration due to the complexity of the chip and software involved though the independent investigators did conclude the chip design was likely at fault! [6] The further significance of this is that it happened in the same era when logic locking and its more simplistic predecessors of IC Camouflaging began reaching ubiquity. With it’s ability to hide corporate chip designs from competitors and the public, IC Camouflaging started getting its first formidable patents sometime between 1994 and 2008 as it was being perfected5 [8].

With the more mature version of IC Camouflaging – logic locking – reaching ubiquity somewhere around 2008 [9,10], today it seems that Toyota is using a combination of black-box logic locked chips that it demands the chip suppliers stockpile for them and, if it can, uses non-black-box chips everywhere else. Before logic locking, Toyota was able to judge all the chip designs they were using. Today, Toyota pays chipmakers to stockpile trade-secret chip designs that cannot be properly judged by Toyota for quality. And now it would seem, Toyota pays chipmakers to stockpile as much as a 6 months supply of chips. In fact, Toyota’s decision to pay a chipmaker to stockpile their chips for them seems to be the tort scheme instituted in the wake of the 2009 car crashes to lay liability on the doorstep of the chipmakers while also avoiding the need for a just-in-time supply-chain.

Still, the shortage has continued for so long that even Toyota – with it’s six month stockpile – can’t get the chips it needs.

Everything points to the fact that the rest of the automakers didn’t stockpile chips because they weren’t allowed to understand the chips they were buying. When interviewed by Fortune magazine, the CEO Tu Le of Sino Auto Insights, an automaker consulting firm, had this to say: “If a chip shortage lasts more than three months, it’s not really a chip shortage… It’s poor supply-chain management.”[11]

Pause to think about that. All the automakers – all of them – have poor supply chain management? It would seem obvious some market pressure must be influencing this ‘poor’ decision making. And it looks to me like that pressure came from the black-box nature of logic locked chips.

Now, let’s cut to the chase. What I infer from this is: given most car companies use of a just-in-time (JIT) supply-chain, it isn’t hard to conclude that the way they are using JIT is a tort scheme to lay liability on the doorstep of the chipmakers. Thinking it through, if you don’t understand the chips and which ones might be vulnerable to some novel hack or bug in a year or two, stockpiling these black-box computer chips becomes a multimillion dollar liability. But purchasing the restrictive intellectual property rights to audit these chips is a larger multimillion dollar problem by itself6. Though as Toyota found out the hard way, shipping chips with known defects can bring federal investigations and a multibillion (that’s right, billion) dollar legal situation.[7] And as a result, the idea that automakers will ever again stockpile black-box-chips themselves, is probably instantly thrown out of any automaker’s boardroom decisions.

Artificial scarcity is the hallmark of how the modern tech industry has made its money. Looking to successful software companies like Microsoft for example, you can’t just copy their software because that would be copyright infringement. Chip designs are copyrighted in the same way. In the case of software companies, the ire of antitrust must have let this artificial scarcity slide because they are never running the risk that their supply-chain will induce shortages of their product; software can be infinitely reproduced almost instantly because it’s supply-chain is digital. But the “fabless” semiconductor companies are basically wannabes of this artificially scarce business model.

The “fabless” semiconductor companies have to contend with the reality of an actual physical supply-chain; this puts it at odds with the copyright business model typical of the software companies they tried to emulate. It is my belief that a sober look at the chip shortage would reveal the artificial scarcity we have allowed to be induced on the microchip market is dangerous, anti-competitive, and would likely paint the picture of our chip economy under strict regulatory capture that should be called what it is: rent-seeking through restrictive practices. And I believe this rent-seeking behavior has likely had an unacknowledged excised role in the severe ongoing chip shortage that will be with us well into 2023.

Paradox Explained? How Logic Locking Induces Artificial Scarcity and the Restrictive Practices of de facto Monopolies

It is a well-known secret in Silicon Valley that the magic sauce to a successful tech company is to have a monopoly while obfuscating the fact that you don’t actually have competitors[12]. This is how the chip industry operates. For example, AMD and Intel chips would like to pretend that their common x86 architecture makes them inter-operable when, in actuality, no one in the industry trusts AMD and Intel chips to run the same workloads without code refactoring. And even the refactoring process more often than not results in a much more buggy program. Therefore AMD and Intel often get de facto monopoly powers on certain markets because a shift away from their chip designs is too hard for some companies with complicated software that runs on their chips. And though neither AMD nor Intel are in the traditional automotive semiconductor market, the same thing has happened to the automakers with their chip suppliers.

When a car company decides on a chipmaker, the vendor that they are choosing gets a nontrivial amount of vendor-lock-in because the automakers become trapped into a particular chip design and only one company is allowed to sell — let alone review — a particular chip design. The chip designs themselves are held under the most restrictive practices imaginable on the part of these chip vendors and as a result they have de facto monopoly power over producers whom rely on those trade-secret designs.

Given that all code that goes into a car is subject to significant regulation7, the cost of integrating a new chip – rewriting, testing and qualifying the software to meet regulatory standards – like Tesla alone did in 2021 – costs a large amount of time and resources. But in general, design cycles for the electronics of the more economically viable automakers are often very long, sometimes a decade long. All of this, makes it very difficult to shift after a chip design is chosen because writing new software without bugs is hard and the regulatory burden complicates the software development process.

It is often not only software that is buggy though, the chips that run the software can have bugs, too.

And if a car company buys a stockpile of black-box chips, then odds are a chipmaker will eventually find a bug in the chip the car company is using. For every time that were to happen, automakers would have a multimillion dollar stockpile of chips with known bugs which cannot be installed in a car because installing them would be a bigger liability than their multimillion dollars worth of unusable warehoused chips. Toyota learned that lesson the hardest way imaginable when they killed 89 people and lost billions in fines and lawsuits. But to help stare these incentives in the face, just consider that in 2019, 15 million car recalls were because of electronic component failures; that accounted for over half of all vehicle recalls that year. And consider, when cars relied on fewer chips back in 2011 the share of car recalls for electronics was a mere 5%[13].

It is most likely that to mitigate the mess I just described, save Toyota, all of the most advanced car makers in the world decided on a just-in-time ordering scheme for the chips they needed. As it is set up now, intellectual-property schemes require that they choose an intellectual property middleman to curate their chips and chip designs. Let’s call these middlemen intellectual-property-slumlords namely because of how their business model abuses the goodwill assumptions baked into the copyright system but also because these slum-chips – if you ask enough engineers, it will not take long to find out that these chips – have a higher failure rate than other industry standard chips8.

Bringing this back to what the pandemic did to supply-chains, now the chip companies can’t deliver on the intellectual-property and supply-chain scheme that allowed them to induce an artificially scarce production and warehouse capacity. And now it would seem, because so many automakers had to design their entire cars around the chip designs of intellectual-property-slumlords, we now have the shortage in cars.

Auto-chip $47B ~Marketshare and Lead Times Worldwide

My last post tries to describe logic locking in laymens terms but for the sake of this post all one needs to understand is that logic locking is how companies both hide their chip designs from the outside world and simultaneously induce artificial scarcity on the market [4,5,9,10]. It seems clear they have been able to avoid the attention of anti-trust’s “restrictive practices” so far by masking their system of artificial scarcity as necessary for chip supply-chain security. And once a company has designed their cars with a certain chip, that chip manufacturer gets de facto monopoly power on a car maker because these car manufacturers are now trapped in to these chip designs that the rest of the car’s electronics use as a foundation for its circuitry.

In order to pinpoint logic locking’s level of responsibility in causing the chip shortage, it would seem that to know this stuff for sure would require testimony under oath from the automaker engineering and supply-chain teams. The automakers would probably not be willing to release this information themselves. But with all that laid out, let’s recap what seem like the three most likely factors that caused the chip shortage affecting industries of everyday necessity from cars, to school buses, to medical devices.

“Fabless” companies lock their chip designs using an obfuscation technique. It’s called logic locking. This induces artificial scarcity and black-boxed designs that cannot be audited by producers — like car companies — which see these chips as an excised liability because the designs are held as closely guarded trade-secrets

Car companies — among others — don’t want the liability of black-box chips sitting in their warehouses but are trapped into a system where they have to choose an intellectual-property-slumlord for the artificially scarce chip designs they require

The pandemic caused an influx of chip orders and other disruptions and now the intellectual-property-slumlords can’t provide their black-box and copyrighted chip designs to producers like car companies

The Solution: The Open Source Way

The problem isn’t that we need better chip companies, its that we need a better chip supply-chain model and I will argue open source offers that. This is going to be the first decade in which subsidies for microchips will finally outstrip that of corn in the United States. So, before anyone at the various non-profits starts lobbying governments for more money, please, lets stop that gravy train before it starts. But if anyone has an idea for turning corn into semiconductors, I’m all ears.

Something needs to give in the semiconductor market. We can’t make our way in a future where the entire industries of the world from cars to personal devices are held hostage by a logic locked chip industry: my future posts will aim to show how the future could and maybe should rely on four ideas to rid our industries of logic locking altogether to create entirely new paradigms in computer security that are both more trustworthy and energy-efficient — especially within safety-critical systems. Those four ideas are:

While also showing how the ideas can prevent the creation of infotech economic fiefdoms, a question I would like to keep in mind as I write about the potential future paradigms in computer security is: how could these paradigms have prevented situations like the Toyota induced car crashes from 2008?

The next time a major problem in computer micro-architecture occurs, we should be able to verify that 89 people need not die before a problem gets merely identified and fixed. And the fact that about 50% of all car recalls in 2019 were due to electronic components, points to the possibility that we need new more secure paradigms for these devices that we have come to rely on in our vehicles, our financial systems and in our homes.

The term “fabless” has always been a misnomer. It really means a company without a foundry and fabrication facility. The important word is foundry, so a better word would have been foundry-less (because foundries cost significantly more money to build than fabrication sites) but that doesn’t role off the tongue as easily. Foundries are where lithography is done, in other words, where a microchip is made; in contrast is a fab, where a device like a phone or laptop is assembled and has its microchips put in it.

A large factor in this is the fact that patents expire after 20 years and copyrights expire after 120 years.

The plaintiffs embedded systems expert team was headed by Phillip Koopman, an associate professor of Electrical and Computer Engineering at Carnegie Mellon University[6.3]. The plaintiffs legal team was The Barr Group, headed by attorney Michael Barr[6.2].

For a detailed explanation watch Carnegie Mellon Professor Phillip Koopman’s lecture detailing his role in the Bookout v. Toyota Motor case investigations here[6.3].

In the literature, logic locking specifically refers to the methods invented after 2008 and is generally considered to be when IC Camouflaging reached modernity with the publication of the seminal paper The End of Piracy for Integrated Circuits more commonly referred to as EPIC [9,10]. More naive versions of IC Camouflaging have been around since at least 1994[8].

One only needs to look at recent lawsuit headlines between ARM v. Qualcomm to see how restrictive these IP laws are and how expensive it can be to finesse them[14].

These are known as EMC requirements.

On top of me personally knowing people familiar with the matter who make these complaints, Bloomerg also reports[15]:

…several automakers have fallen into the trap of unwittingly buying second-hand chips that have been removed from discarded auto parts and sold as new, people familiar with the matter said.

“Reused chips can cause problems because they might have been built for too small a temperature range, for example,” said Phil Koopman, an associate professor of electronic and computer engineering at Carnegie Mellon University. He’s been involved with automotive chip design and safety for around 30 years. … These chips can easily slip into vehicles unnoticed, he said.

And not only that, sometimes these black-box chip designs don’t even do what their specifications say they should do.

References

[0] Intel, Micron CEOs testify before Senate on semiconductor chips manufacturing — 3/23/22,” www.youtube.com. youtu.be/yPB79ZpZiHc?t=147 (accessed Dec. 26, 2022).

[1] “Automotive semiconductor shortage over? – SC-IQ: Semiconductor Intelligence.” https://www.semiconductorintelligence.com/automotive-semiconductor-shortage-over/ (accessed Dec. 26, 2022).

[2.]

J. Sohn, “Semiconductor Industry Isn’t Spending Big on Scarce Old-Tech Chips,” Wall Street Journal, Nov. 09, 2021. [Online]. Available: https://www.wsj.com/articles/semiconductor-industry-isnt-spending-big-on-scarce-old-tech-chips-11636453801

Shortage of Legacy Chips Keeping Ford CEO Up at Night,” Bloomberg.com, Nov. 18, 2022. [Online]. Available: https://www.bloomberg.com/news/articles/2022-11-18/shortage-of-legacy-chips-keeping-ford-ceo-up-at-night

“Carmakers to suffer chip shortages until at least end of 2023,” Financial Times, Dec. 20, 2022. [Online]. Available: https://www.ft.com/content/e0265ef6-21b7-4624-b179-42685aad822f

[3.]

C. Miller, Chip War. Simon and Schuster, 2022.

G. Leopold, “Car Makers Reap What’s Sown During Chip Shortage,” EE Times, Oct. 14, 2021. https://www.eetimes.com/car-makers-reap-whats-sewn-during-chip-shortage/ (accessed Dec. 26, 2022).

“Auto semiconductor shortage worsens – SC-IQ: Semiconductor Intelligence.” https://www.semiconductorintelligence.com/auto-semiconductor-shortage-worsens/ (accessed Dec. 26, 2022).

D. Opsahl, “Council Post: The Semiconductor Shortage: Are Car Companies Now Consumer Electronic Companies?,” Forbes. https://www.forbes.com/sites/forbesbusinesscouncil/2021/04/14/the-semiconductor-shortage-are-car-companies-now-consumer-electronic-companies/ (accessed Dec. 26, 2022).

“Second Quarter FY 2022 Quarterly Update Infineon Technologies AG Investor Relations.” [Online]. Available: https://www.infineon.com/dgdl/2022-05-09+Q2+FY22+Investor+Presentation.pdf?fileId=8ac78c8b808544e20180a4d32bb70009

[4] K. Xiao, D. Forte, Y. Jin, R. Karri, S. Bhunia, and M. Tehranipoor, “Hardware Trojans: Lessons Learned after One Decade of Research,” ACM Transactions on Design Automation of Electronic Systems, vol. 22, no. 1, pp. 1–23, Dec. 2016, doi: 10.1145/2906147.

[5] S. Engels, M. Hoffmann, and C. Paar, “A critical view on the real-world security of logic locking,” Journal of Cryptographic Engineering, vol. 12, no. 3, pp. 229–244, Aug. 2022, doi: 10.1007/s13389-022-00294-x.

[6.]

These references should be understood together:

CBS News AP, “Toyota ‘Unintended Acceleration’ Has Killed 89,” Cbsnews.com, May 25, 2010. https://www.cbsnews.com/news/toyota-unintended-acceleration-has-killed-89/

J. Yoshida, “EETimes - Toyota Case: Single Bit Flip That Killed,” EETimes, Oct. 25, 2013. https://www.eetimes.com/toyota-case-single-bit-flip-that-killed/

M. Barr and B. Toyota, “2005 Camry L4 Software Analysis.” [Online]. Available: https://www.safetyresearch.net/Library/BarrSlides_FINAL_SCRUBBED.pdf

P. Koopman, “Carnegie Melon University — A Case Study of Toyota Unintended Acceleration and Software Safety,” www.youtube.com. youtube.com/watch?v=DKHa7rxkvK8 (accessed Dec. 26, 2022).

[7.]

These references should be understood together:

“Major Recalls - Toyota Sudden Acceleration,” The Center for Auto Safety, Mar. 31, 2014. https://www.autosafety.org/major-recalls-toyota-sudden-acceleration/

B. ROSS, “Toyota to Pay $1.2B for Hiding Deadly ‘Unintended Acceleration,’” ABC News, Mar. 19, 2014. https://abcnews.go.com/Blotter/toyota-pay-12b-hiding-deadly-unintended-acceleration/story?id=22972214

ABC News, “Toyota Driver: ABC News Videos Helped Save My Life,” ABC News. abcnews.go.com/Blotter/toyota-driver-abc-news-videos-helped-save-life/story?id=9618954 (accessed Dec. 26, 2022).

And archive.org of the now removed link covering the actual investigation.

[8.]

Early Flashing-glue:

C. R. Bearinger, R. C. Camilletti, L. A. Haluska, and K. W. Michael, “Method of applying opaque coatings,” 1994 https://patents.google.com/patent/US5399441A/en (accessed Dec. 26, 2022).

Early IC Camouflaging:

J. P. Baukus, L. W. Chow, and W. M. C. Jr, “Digital circuit with transistor geometry and channel stops providing camouflage against reverse engineering,” 1995 https://patents.google.com/patent/US5783846A/en (accessed Dec. 26, 2022).

J. P. Baukus, L. W. Chow, and W. M. C. Jr, “Digital circuit with transistor geometry and channel stops providing camouflage against reverse engineering.”, 1995 https://patents.google.com/patent/US5930663A/en (accessed Dec. 26, 2022).

[9] J. A. Roy, F. Koushanfar, and I. L. Markov, “EPIC: Ending Piracy of Integrated Circuits,” IEEE Xplore, Mar. 01, 2008. https://ieeexplore.ieee.org/document/4484823 (accessed Oct. 10, 2022).

[10] Dominik Sisejkovic and Rainer Leupers, Logic Locking. Springer Nature, 2022 (accessed Dec. 26, 2022).

[11] E. Barrett, “How Toyota kept making cars when the chips were down,” Fortune, Aug. 02, 2021. https://fortune.com/2021/08/02/toyota-cars-chip-shortage-semiconductors/

[12.]

P. Thiel and B. Masters, Zero to one : notes on startups, or how to build the future. London: Virgin Books, Cop, 2014.

“Stanford University — Lecture 5 Business Strategy and Monopoly Theory – P. Thiel,” www.youtube.com. youtu.be/GaDDmyWPwrg (accessed Dec. 26, 2022).

[13] R. Charette, “How Software Is Eating the Car,” IEEE Spectrum, Jun. 07, 2021. https://spectrum.ieee.org/software-eating-car

[14] K. Leswing, “Why Arm’s lawsuit against Qualcomm is a big deal,” CNBC. https://www.cnbc.com/2022/09/01/why-arms-lawsuit-against-qualcomm-is-a-big-deal.html (accessed Dec. 26, 2022).

[15] “China’s Underground Market for Chips Draws Desperate Automakers,” Bloomberg.com, Oct. 19, 2022. Accessed: Dec. 26, 2022. [Online]. Available: https://www.bloomberg.com/news/articles/2022-10-19/us-chip-sanctions-and-covid-spawn-china-s-secondhand-semiconductor-market